- What is Entrepreneurship and who is an Entrepreneur ?

- Principles of Entrepreneurship

- Entrepreneurial Finance

- Entrepreneurial Ecosystem

- Top Five Reasons why Entrepreneurs Fail

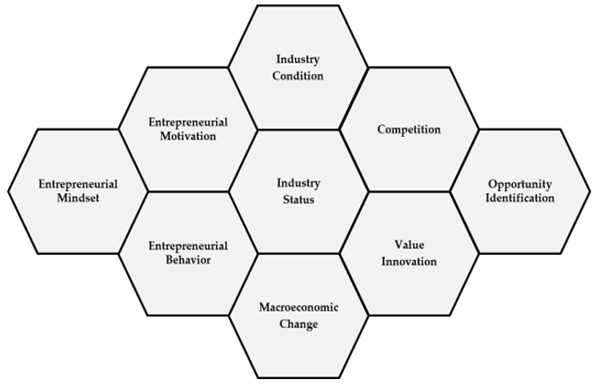

- Factors Which Affect Entrepreneurship

- The Role of Entrepreneurs in the Economies of Nations

- When Should Entrepreneurs Transition to Next Generation of Leaders

- Venture Capitalists and Irrational Exuberance

- Working for Startups - Pros and Cons

- Public Private Partnership Projects: The Indian Experience

- Economics of Public Private Partnerships

- Entrepreneurship in Emerging Economies

- Entrepreneurial Challenges and Opportunities in Asia

- Entrepreneurs and Hot Money Flows and Investments

- Why Entrepreneurs must be Opportunists and be in Control over their Future

- Emerging World of Entrepreneurship: Unicorns and Billion Dollar Start-ups

- Why the Rule of Law is an absolute Necessity for Businesses to Prosper

- The Dynamics of Small Entrepreneurs and Their Importance in Developing Countries

- Entrepreneurial Ecosystems and the Emerging Start-up Boom around the World

- Some Pitfalls that Entrepreneurs Must Avoid for Continued Success of their Ventures

- Opportunity Canvas Analysis and Why it is Important to Entrepreneurs ?

- The Truth About Pyramid Schemes

- Making Money Online - An Introductory Overview

- Why Businesses Must Protect Themselves From Cyber Threats and Cyber Warfare ?

- The Startup Game: Why Do Startups Fail ?

- Mindset Change Needed when Pursuing Online Income Generating Opportunities

- The Future of Entrepreneurship

What is Entrepreneurship and Who is an Entrepreneur ?

We often hear that so and so is an entrepreneur who has started his or her own business. It is also the case that when we hear the term entrepreneur, we tend to associate it with a person who has or is starting their own ventures or in other words, striking it on their own. This is indeed the case as the formal definition of Entrepreneurship is that it is the process of starting a business or an organization for profit or for social needs. We have used the phrase for profit or for social needs to delineate and separate the commercial entrepreneurship from social and charitable entrepreneurship. After defining entrepreneurship, it is now time to define who an entrepreneur is and what he or she does.An entrepreneur is someone who develops a business model, acquires the necessary physical and human capital to start a new venture, and operationalizes it and is responsible for its success or failure. Note the emphasis of the phrase responsible for success or failure as the entrepreneur is distinct from the professional manager in the sense that the former either invests his or her own resources or raises capital from external sources and thus takes the blame for the failure as well as reaps the rewards in case of success whereas the latter or the professional manager does the job and the work assigned to him or her for a monetary consideration. In other words, the entrepreneur is the risk taker and an innovator in addition to being a creator of new enterprises whereas the professional manager is simply the executor.

Attributes of Entrepreneurs

Moving to the skills and capabilities that an entrepreneur needs to have, first and foremost, he or she has to be an innovator who has a game changing idea or a potentially new concept that can succeed in the crowded marketplace. Note that investors usually tend to invest in ideas and concepts which they feel would generate adequate returns for their capital and investments and hence, the entrepreneur needs to have a truly innovative idea for a new venture.Leadership Qualities

Apart from this, the entrepreneur needs to have excellent organizational and people management skills as he or she has to build the organization or the venture from scratch and has to bond with his or her employees as well as vibe well with the other stakeholders to ensure success of the venture.Further, the entrepreneur needs to be a leader who can inspire his or her employees as well as be a visionary and a person with a sense of mission as it is important that the entrepreneur motivates and drives the venture. This means that leadership, values, team building skills, and managerial abilities are the key skills and attributes that an entrepreneur needs to have.

Creative Destruction and Entrepreneurship

We often hear the term creative destruction being spoken about when talking about how some companies fade away whereas others succeed as well as maintain their leadership position in the marketplace. Creative destruction refers to the replacement of inferior products and companies by more efficient, innovative, and creative ones wherein the capitalist market based ecosystem ensures that only the best and brightest survive whereas others are blown away by the gales of creative destruction. In other words, entrepreneurs with game changing ideas and the skills and attributes that are needed to succeed ensure that their products, brands, and ventures take market share away from existing companies that are either not creating values or are simply inefficient and stuck in a time warp wherein they are unable to see the writing on the wall. Therefore, this process of destroying the old and the inefficient through newer and creative ideas is referred to as creative destruction which is often what the entrepreneur does when he or she launches a new venture.An Entrepreneur is a Risk Taker

We have discussed what entrepreneurship is and the skills and attributes needed by entrepreneurs along with how they engage and indulge in creative destruction. This does not mean that all entrepreneurs are successful as the fact that they can become victims of creative destruction as well as due to lack of the other traits means that a majority of new ventures do not survive past the one year mark of their existence. Now, when ventures fail, the obvious question is who takes the blame for the failure and whose money is being lost. The answer is that the entrepreneur puts his or her own money or raises capital from angel investors and venture capitalists which means in case the venture goes belly up, the entrepreneur and the investors lose money. Note that as mentioned earlier, the employees and the professional managers lose their jobs and unless they are partners in the venture, their money is not at stake. Therefore, this means that the entrepreneur is the risk taker in the venture which means that the success or failure of the firm reflects on the entrepreneur.Some Famous Entrepreneurs

Given this basic introduction to entrepreneurship, we can now turn to some famous examples of entrepreneurs who have succeeded despite heavy odds because they had game changing ideas and more importantly, they also had the necessary traits and skills that would make them legendary. For instance, both the founder of Microsoft, Bill Gates, and the late Steve Jobs, the founder of Apple, were college dropouts though their eventual success meant that they had not only truly innovative ideas, but they were also ready to strike it out for the longer term and hang on when the going got tough. Even the founder of Facebook, Mark Zuckerberg, as well as Google’s Larry Paige and Sergey Brian can be considered as truly revolutionary entrepreneurs. What all these legends have in common is that they had the vision and the sense of mission that they were going to change the world and with hard work, perseverance, and a nurturing ecosystem, they were able to self actualizes themselves.Entrepreneurship Needs a Nurturing Ecosystem

Finally, note the use of the term nurturing ecosystem. This means that just as entrepreneurs cannot succeed if they lack the necessary attributes, they cannot succeed even having them but living in an environment or a country that does not encourage risk or tolerate failure and more importantly, is unable to provide them with the monetary and human capital needed for success. This means that the United States remains the preeminent country for entrepreneurship as it has the ecosystem needed for these entrepreneurs to succeed whereas in many countries, it is often impossible or difficult to find funding, work through red tape, and ensure that the environmental factors do not inhibit entrepreneurship.Principles of Entrepreneurship

Entrepreneurs need to follow some basic principles which would serve as guidelines and beacons for their success. Based on the research conducted over a period of three years and by interviewing more than 150 entrepreneurs, noted author and management expert, Bill Murphy came out with a book about entrepreneurship which was published by Harvard Business School. This article is based on the insights from this book and lists five principles that should serve as markers for both aspiring as well as existing entrepreneurs. One of the insights from this research is that most of these principles can be learned from experience and the process of starting a venture is an educational experience in itself. With this introduction, we can now move on to the five principles of entrepreneurship as put forward by Bill Murphy.It is always not the case that Entrepreneurs should make money fast and this should not be the goal

It is important for entrepreneurs to test the waters before launching a new venture. This means that one must commit oneself to the ideal of entrepreneurship and try out new business models, and new forms and paradigms of transacting business. In other words, the entrepreneurs must not be in a hurry to make profits from the word go and instead, understand what entrepreneurship is all about. For instance, it is better to come up with a game changing idea instead of pursuing leads that are dead ends which means that entrepreneurs must be ready to be in the game for the long haul.It is always better to find the right opportunity even if it takes time instead of chasing mirages

This principle translates into waiting for the right opportunity and at the same time, seizing the moment when the opportunity arises. Of course, we are not saying that entrepreneurs ought to wait forever for the right opportunity. Rather, the intention here is that entrepreneurs must ensure that they have the necessary foundation in place to capitalize on the opportunity and also must have an idea and a business model that would create opportunities in case they are finding it difficult to get the venture going. For instance, as the clich�s about how opportunity knocks only once as well as if you do not find an opportunity, build a door so that you are ready when the opportunity arises can be taken to mean that entrepreneurs must both create opportunities as well as seize them when they arise. Another analogy would be that entrepreneurs must be ready with the fishing rods and the baits when they go fishing and if the river, sea, or lake is saturated, they must fish in waters that are “blue oceans” meaning that they must create new markets for themselves.Invest in people and build successful teams

As with the previous principle, entrepreneurs must ensure that they have the right team in place before they start the venture. After all, unless there is a team in place, the venture would not be able to capitalize on the opportunities. Further, entrepreneurs must ensure that the team is passionate, committed, and most importantly, shares the vision and mission of the founders. In other words, unless there is a buy-in from the team with the founder’s ideas, the venture would flounder. Apart from these, getting the right people who have focus, drive, loyalty, determination, courage, and consistency in addition to being motivated and creative are some requirements that the entrepreneurs can ill afford to ignore.It is always not enough to have everything in place. Execution and Delivery are what matters

Have you ever got the feeling that a salesperson is engaging you in glib talk wherein he or she is trying to convince you to buy a product which is untested? Similarly, all talk and no execution would lead the new venture nowhere and hence, it is important for entrepreneurs to ensure that they walk the talk and deliver on their promises.Indeed, it is not enough to have a game changing idea and a great team in place unless the entrepreneur knows the art of execution. As happened during the Dotcom boom, there were many startups with great ideas and equally great teams that promised the moon for anyone willing to listen. However, the fact that they failed in their businesses was mainly due to the gap between ideas and execution.

Therefore, the entrepreneur has to be a leader who walks the talk and understands the meaning of execution. Further, leadership means that entrepreneurs must not be afraid of failure and must instead, turn adversity into triumph and transform failure into a stepping stone for success.

Indeed, great entrepreneurs are those who are willing to trust their instincts and intuition and back themselves up when the venture is yet to fructify or even making losses. In other words, if you think that you have a great idea and are executing it well with the right team, you need to persist and keep going even when the conventional wisdom says that you are getting it wrong.

Entrepreneurs must be self actualizing visionaries

Ask any successful entrepreneur and they would say that while money is indeed important and profits are indeed essential, it is always not about the money or that making profits is the only thing that matters. Instead, great entrepreneurship is all about heeding the inner voice, creating jobs and opportunities for others, be conscious of societal prosperity due to the venture instead of having a me, myself only attitude, and most importantly, translate their vision into success.For instance, there are many of us who have heard or come across individuals who gave up cushy jobs to find their passions and to follow and chase their dreams. Therefore, successful entrepreneurship is all about making a difference to the world and becoming a social messiah who would transform societies with his or her ventures.

Finally, entrepreneurship must be seen as a starting point to transform oneself and in the process become a change agent. For this to happen, the entrepreneur must be both be able to fulfill environmental, social, and economic expectations from the larger system and at the same time, must drive themselves in the pursuit of their dreams. Indeed, the balance between inner aspirations and external expectations is the most important determinant for success.

Entrepreneurial Finance

Description

This article discusses the various forms of financing for new ventures. It is indeed the case that any new venture would need capital and more often than not, entrepreneurs need significant capital for launching their ventures. Further, this article also discusses how Angel Investors have become important in recent years and examines how buyouts take place in the business world.Need for Financing

Any new venture needs financing and hence, entrepreneurs have to decide where to get funding from, how to invest, and how much to borrow. This article is concerned with the sources of entrepreneurial finance which the entrepreneur has access to. Indeed, one of the central preoccupations for entrepreneurs is where and from to get the funding in order to kick start their ventures and hit the ground running.Bootstrapping

This form of financing the ventures applies when entrepreneurs invest their own money, or offer stakes in their venture to individuals in return for their services, as well as includes other forms of financing such as delaying payments to partners, offering sweat equity to employees and other stakeholders etc. The important point to note about bootstrapping is that it can be actualized only when the entrepreneur does not need significant amounts of capital as all the methods mentioned above relate to investments that are limited in their capital mobilization. Another important aspect of this type of financing is that entrepreneurs typically offer equity in return for work done which is a non-monetized form of financing known as sweat equity.External Financing

This type of financing is the most common for entrepreneurs and this category includes all the types of financing mentioned subsequently. When compared to bootstrapping where the entrepreneur raises money either from internal sources or by offering equity in return for work, external financing often involves sourcing capital from external sources which are tangible and immediately monetized forms of financing. Apart from the types of external financing described below, private equity or equity to large investors in return for financing is often the norm for entrepreneurs.Angel Investors

We often hear the term Angel Investor spoken by entrepreneurs or mentioned in the business press. Angel Investors as the name implies are literally and metaphorically the Knights in Shining Armour to the entrepreneurs as they not only invest their own monies but are also known to guide the entrepreneurs in actualizing a successful business model. Indeed, Angel Investors are also known to invest in new ventures as a means of doing good for society as well as to share their wealth with new and up and coming entrepreneurs who they (The Angel Investors) think have a game changing idea. Moreover, Angel Investors in many cases are successful entrepreneurs themselves and hence, mentor the new entrepreneurs in the same way managers and role models mentor promising employees. It is also the case that in recent years, Angel Investors have invested nearly three times the amount of money as raised through venture capitalists.Venture Capitalists

Venture capitalists differ from Angel Investors in the sense that while the latter invest their own money and often do so for giving back to society, the former invest in new ventures with capital that their professionally managed investment firms have accumulated from private investors. In other words, venture capitalists often act as representatives of individuals and trusts with capital to spare and do so for profit oriented purposes rather than the for fun investments by Angel Investors.Further, venture capitalists need a compelling business model and its presentation by the entrepreneurs as they are in the business of investing for profit and hence, need to generate returns on their capital.

Buyouts

This type of financing happens when the entrepreneur sells his or her stake in the venture to individual or a group of investors. However, buyouts are also used to refer to instances when private equity firms pick up stakes in new ventures where the majority stake is still with the entrepreneur. Moreover, buyouts are latter stage investments which mean that by the time the buyouts happen, the venture is already into its growth phase or in the process of being on the road to profitability. Having said that, it must be noted that buyouts also happen when the investors realize that ventures have good assets which can fetch returns as well as have the potential to grow and generate value in the future. Buyouts can also be hostile meaning that the entrepreneur might be forced to give up his or her stake in cases where the private equity or the other investors decide that a change of ownership would be good for the venture. Finally, buyouts happen when the venture is also in the process of winding up as some investors might want to pick up assets on the cheap and sell them off piecemeal.Entrepreneurial Ecosystem

What is an Entrepreneurial Ecosystem?

All of us are endowed with skills, abilities, and capabilities. However, the reason why some of us are so successful whereas others languish is mainly due to the way in which these traits are nurtured, encouraged, and enabled. For instance, we need to go to the right schools, have supportive families, and be mentored at all stages of our lives so that we do not make any missteps or commit blunders and mistakes that would prove detrimental to our progress. In other words, talent has to be nurtured if it has to flourish. In the same manner in which this happens in our individual lives, entrepreneurs too need enabling and empowering environments which not only ensure that their game changing ideas are translated into actionable pursuits but also ensure that these entrepreneurs have the necessary ecosystem in which they can thrive and prosper. In short, the entrepreneurial ecosystem comprises of the all the stakeholders including government, bureaucracy, funders, and consumers.The Example of Bangalore

To start with, let us take the example of Bangalore, the Indian IT (Information Technology) hub, which is often referred to as the Silicon Valley of India. The reason why Bangalore became a hotspot for innovation and global corporations is that it offered a serene and salubrious environment (including the weather) in terms of readily available pool of talent, an unobtrusive government which unlike the Indian way of interfering in business did its best to keep out of the Indian IT industry and its growth, enabling laws and tax breaks that encouraged companies to reap the benefits, and most importantly, a thriving culture of innovation that was long the characteristic of the city before the IT industry made it its home. Indeed, all these factors ensured that Indian entrepreneurs such as the founders of now global brands like Infosys, Wipro, TCS, and other companies have an enabling and empowering entrepreneurial ecosystem which made them thrive and prosper.The Original Silicon Valley

Of course, the blueprint for this ecosystem originated in the Silicon Valley of California in the United States wherein global behemoths such as Apple, Google, and Microsoft in addition to Facebook and thousands of other startups found that the entrepreneurial ecosystem there was eminently suitable for them to start their companies and prosper. Indeed, the fact that Silicon Valley is thriving despite the recession is an indicator of how the region has moved beyond the vicissitudes of the market and carved its own niche as a place where entrepreneurs can thrive. Further, China that has emerged in recent years as an entrepreneurs dream come true has followed the footsteps of Silicon Valley and has indeed, done better than it on many counts such as minimal governmental interference and maximum benefits which prove to be the right nourishment for businesses and entrepreneurs to thrive.Components of an Entrepreneurial Ecosystem

Thus, for the actualization of an enabling and empowering entrepreneurial ecosystem, there need to be venture capitalists who would fund the startups and angel investors who persist with the ventures despite initial hiccups. Next, the government has to have laws and policies that would encourage entrepreneurs by giving them tax breaks, benefits, and land and facilities including roads, infrastructure such as international airports and the like so that global investors flock to these ecosystems. Further, the bureaucracy should not throw spanners in the works of the entrepreneurs through meaningless rules and regulations and instead, must speed up the decision making process as well as implement single window clearances. Moreover, there must be a talent pool of skilled and employable workers who would staff the startups and ensure that when they take off, the ventures have the necessary people to drive their businesses.Why the Chinese are racing ahead?

Therefore, after considering the factors which go into making an enabling and empowering entrepreneurial ecosystem, it is clear that unless these aspects are taken care of, the inventors, and the entrepreneurs would take their business elsewhere. Indeed, if the example of China is anything to go by, it is that it has stolen a march over India on many of these aspects as not only does it offer the right ecosystem, it also ensures that the entrepreneurs are treated as heroes and heroic figures who are no less important than the politicians and other personalities who are regularly feted by society. In short, the lesson for any country is that global capital is country blind and region blind and just as the early bird catches the worm, the regions and the countries that are at the forefront of the race to attract global capital would win in the end.Conclusion

Before concluding this article, it would be pertinent to note that some of the aspects which ensure an enabling entrepreneurial ecosystem such as land and water and infrastructure seem mundane in the light of the other aspects such as access to funding and laws and regulations. However, if recent events in India and other parts of Asia where the ecosystems for entrepreneurs are being built are any indication, these factors are as important to the entrepreneur as is the aspect that he or she needs to have a game changing idea and be ready to take it to the next level. indeed, the fact that many global corporations are now flocking to India after moving elsewhere for much of the last few years is mainly due to the change in priorities in the Indian policymakers who desperately need investments and jobs as otherwise, they would not only be left behind but also would risk the dropping out of the race altogether which in the globalized world economy is a surefire recipe for disaster.Top Five Reasons why Entrepreneurs Fail

Introduction

Entrepreneurship is a tricky thing and unless, entrepreneurs are on top of the game all the time, the chances for failure are very high. Research has shown that not more than 10% of all new ventures go past the second year of their existence and that entrepreneurs often end up on the wrong side of success. This article examines and discusses the top five reasons why entrepreneurs fail and these relate to funding, staffing, financials, operational reasons, and peaking too early or too late. All these reasons have the common theme of not managing the venture successfully and being lax or lazy as far as the nuts and bolts of managing the venture is concerned.Further, the other theme that runs through these reasons is missing the trees for the forest or not paying enough attention to details and at the same time, missing the forest for the trees or getting too bogged down in the details that the big picture is ignored.

Problems with Funding

The first of these reasons relates to the funding aspect. As we all know, new ventures and startups need funding at all stages of their lifecycle and hence, the entrepreneur has to ensure that the venture capitalists and the financial institutions back him or her from the word go and continue their assistance throughout the process.

Often, it is the case that entrepreneurs fail to deceive as the idea which looks good initially fails to generate revenue or business leading to the venture capitalists developing cold feet and backing out from the venture. Apart from this, it is also the case that some startups and their founders do not anticipate the continuous cash flow that is needed to keep the venture afloat and we shall be discussing this in detail separately.

Staffing Issues

The second reason why entrepreneurs fail is related to staffing wherein the entrepreneurs often do not staff their ventures with the right resources and often fail to have the required resources when the venture takes off. For instance, in these days, it is the case that the ventures need enough resources when the projects roll in or when business picks up. On the other hand, having too many resources is also a drag on the venture as resources cost money and time to maintain. Further, not having the right resources because either they are too expensive or they do not want to take the chance of working for a startup. Indeed, gone are the heady days of the dotcom boom when just everyone and everybody wanted to work for a startup. Nowadays, many employees do not want to risk their futures by joining a startup whose future is uncertain.

Cash Crunch and Drying up of Liquidity

The third reason why new ventures fail is related to the financials or the managing of the cash flows which have been mentioned earlier. This aspect has to do with the fact that most entrepreneurs fail to anticipate the cash crunch which arises from the imbalance between accounts payable and the accounts receivables.

Further, it is often the case that new ventures budget for revenues in the future now and this means that unless the revenues materialize, the venture would run out of cash. Moreover, it is also the case that the funding from the venture capitalists might dry up suddenly leading to liquidity problems. Indeed, though the venture might postpone receivables to the future, it cannot do the same with the payables wherein suppliers, staff, and vendors cannot be assured that the entrepreneur would honor the commitments as can be seen in the way the Aviation sector in India has seen some high profile closures in recent years.

Operational Mismanagement

The fourth reason why new ventures fail is the operational aspect wherein the entrepreneur fails to manage the nuts and bolts of running the business in an effective, efficient, and efficacious manner. For instance, many entrepreneurs often do not involve themselves in the ground realities of running the business and leave this to others wherein they concentrate on the bigger picture. Though we are not advocating that all entrepreneurs should micromanage their businesses, some amount of involvement with the day to day running is essential and indeed, critical. This means that the entrepreneur should handhold the business especially in the formative years or the first year at the minimum to ensure that there is no slip between the cup and the lip where the translation of ideas into the running of the business is concerned. Often, many entrepreneurs consider it beneath themselves to engage and involve in say things such as work schedules, human resources, and day to day financials and end up paying the price for such negligence.

Peaking too Early or Too Late

The fifth reason why many entrepreneurs fail is that their ventures often peak early or peak late leading to missing the curve when the right combination of ideation, incubation, and execution is actualized leading to success. For instance, some entrepreneurs have great and game changing ideas but peak too early meaning that they misread the signals from the market. This often leads to burnout and fatigue especially when the desired momentum has to be generated. On the other hand, some entrepreneurs peak too late meaning that they misjudge the timing when their products or the solutions have to be brought to the market. In both cases, the imperative is to ensure that the time from ideation to bringing to the market is just about right.

Factors Which Affect Entrepreneurship

Entrepreneurship is essential for the development of any economy. Countries which have flourished attribute their rise to the growth of entrepreneurship. Therefore, governments and people all over the world want to encourage this concept. This article lists down the factors which contribute to the growth of entrepreneurship and therefore to the growth of the economy of any given area.Political Factors

Political factors play a huge role in the development of entrepreneurship in a given geographical area. This is because politicians decide the type of market that is in place. The market could be capitalistic, communist or some countries have adopted a mixed economy. Each of these three markets has very different implications for the way in which entrepreneurs are required to function. Capitalism requires breakthrough innovation whereas communism requires entrepreneurs to be well connected with the political class. Therefore, it has been observed that the more capitalistic any country is, the more entrepreneurship flourishes in the region.Legal Factors

Entrepreneurs are dependent upon law for a wide variety of factors. The strength and fairness of the legal system of a nation affect the quality of entrepreneurship to a large extent. This is because entrepreneurs require a wide variety of legal services to function. For instance, entrepreneurs would require the courts to enforce the contracts that were entered to between parties. In many countries such contracts are not enforceable and therefore the resultant risk prohibits the development of entrepreneurship. Then again, the entrepreneurs are dependent on the courts for the protection of their property rights. Also, many advanced countries have noticed that the provision of declaring bankruptcy has been positively associated with the development of entrepreneurship. Entrepreneurs do fail a few times before they find the right innovation that leads to their success. The United States is amongst the countries with the highest rate of entrepreneurial development and it is also known to have one of the most advanced bankruptcy laws! Even business legends like Henry Ford had declared bankruptcy in their early days.Taxation

The government can also influence a high degree of control on the market through provisions of taxation. Some amount of taxation is necessary for the government to maintain the legal and administrative systems in place for the entire economy. However, a lot of times governments resort to excessive taxation. They usually adopt the policy of beggaring the rich and giving it off to the poor. This goes against the basic tenets of entrepreneurship which believes in survival of the fittest. Therefore, countries where tax regimes are restrictive find an outflow of entrepreneurs. In short, entrepreneurs want to set up shop in places where there is minimal interference from the government.Availability of Capital

The degree to which the capital markets of a nation are developed also play a huge role in the development of entrepreneurship in a given region. Entrepreneurs require capital to start risky ventures and also require instant capital to scale up the business quickly if the idea is found to be successful. Therefore, countries which have a well developed system of providing capital at every stage i.e. seed capital, venture capital, private equity and well developed stock and bond markets experience a higher degree of economic growth led by entrepreneurship.Labor Markets

Labor is an important factor of production for almost any kind of product or service. The fortunes of the entrepreneurs are therefore dependent on the availability of skilled labor at reasonable prices. However, in many countries labor has become unionized. They demand higher wages from the entrepreneurs and prohibit other workers from working at a lower price. This creates an upward surge in the costs required to produce and as such has a negative effect on entrepreneurship.With the advent of globalization, entrepreneurs have witnessed the freedom to move their operations to countries where labor markets are more favorable to them. This is the reason why countries like China, India and Bangladesh have witnessed a huge rise in entrepreneurial activity in their countries.

Raw Materials

Just like labor, raw material consisting of natural resources is also an essential product required for any industry. In some countries this raw material is available through the market by paying a fair price. However, in some countries seller cartels gain complete control over these natural resources. They sell the raw materials at inflated prices and therefore usurp most of the profit that the entrepreneur can obtain. Therefore, countries where the supply of raw material faces such issues witness depletion in the number of entrepreneurial ventures over time.Infrastructure

Lastly, there are some services which are required by almost every industry to flourish. These services would include transport, electricity etc. Since these services are so basic, they can be referred to as the infrastructure which is required to develop any business. Therefore, if any country focuses on increasing the efficiency of these services, they are likely to impact the businesses of almost all entrepreneurs in the region. Therefore, countries which have a well developed infrastructure system witness high growth of entrepreneurship and the opposite is also true.Of course, the above list of factors is not exhaustive. Entrepreneurship is far too complex a subject to capture in a few bullet points. However, the above list does provide an indication towards the type of factors that can play an important role.

The Role of Entrepreneurs in the Economies of Nations

Introduction

Entrepreneurs have a critical role to play in shaping the futures of the economies of nations. By creating value through starting businesses and ventures, they ensure that the wealth of the nations increases. Similarly, by exporting goods and services, they ensure that the economies earn valuable foreign exchange that is vital for the countries to import the necessary goods and services. In addition, by creating jobs, they ensure that the people in the nations are gainfully employed. Moreover, through their social causes and championing of public good endeavors, they actualize sustainability, social justice, and environmental responsibility. Perhaps the biggest contribution or the underlying theme that runs through all these contributions is their innate ability to innovate that ensures speedy and efficient development of nations and their economies. As we shall discuss in the next section, innovation is the differentiator between the success and failures of nations and their economies.Innovation is the Key to Success

To understand the role and the importance of innovation, one must consider how Europe pulled ahead of China and India through the “great divergence” in the time of the First Industrial Revolution in the late eighteenth and nineteenth centuries. Before this, Asia was the dominant economic player in the world. However with the advent of the First Industrial Revolution, European economies took off in a big way. The reason for this was the entrepreneurial spirit and the innovative use of technology in the Continent which was responsible for its aggressive growth and subsequent dominance which continues to this day. Hence, this aspect which underscores the importance of innovation is the biggest contribution that entrepreneurs make in the development of nations. Indeed, the First Industrial Revolution is a testament to the individual hard work, collective innovation, and national renaissance which was all due to the astounding courage and initiative displayed by the entrepreneurs.How Some Nations Prosper and others Fail

Turning to the aftermath of the world wars when countries had to be rebuilt and economies had to be developed, it is indeed the case that through the same qualities noted above, the entrepreneurs in some countries succeeded in ensuring that those countries emerged out of the rubble and the chaos to become successes. We are talking about Germany, Japan, and some Asian countries such as South Korea wherein the entrepreneurial spirit in addition to and with some help from the governments ensured that these economies pulled ahead of others such as China and India. Indeed, if not anything, the governments and the state should at least not come in the way of the entrepreneurs and stifle their creativity and innovation if they cannot enable and empower them. As we shall discuss in the next section, China realized this aspect sooner than India which again accounts for the differences in the development of these countries.The Role of the State

As mentioned earlier, the unleashing of entrepreneurial spirit and dynamism in addition to innovation calls for an increased role of the state where it has to provide the infrastructure or the hardware for the entrepreneurs to succeed. Similar to a computer where the software sits on top of the hardware, the entrepreneurs can succeed by creating the necessary software only when the hardware is in place. It is indeed to the credit of the Chinese government and the leadership that though this realization came late, they were able to jumpstart the economy and ensures that their country becomes an economic superpower. As for India, the fact that it has realized that it is better late than never in ensuring that entrepreneurial energies are unleashed means that it is on its way to emerging from the abyss of underdevelopment and backwardness.Entrepreneurs keep Economies going

Some experts in recent years have gone so far as to state that it is the entrepreneurs who keep the countries from collapsing due to social and political factors. Imagine how a typical day begins and plays it out in our everyday lives. No matter what would have happened the previous day, the first thing you get in the morning is the milk and the essential goods in addition to the newspapers and other items that are critical for everyday existence. Who delivers all these items rain or shine are the entrepreneurs millions of whom contribute and lubricate the levers of the everyday lives of peoples and shape the economic trajectories of nations. Indeed, the fact that it is entrepreneurs who keep the country from collapsing is made clearer when one considers how countries like India seem to bounce back from crises and step back from the abyss whenever there is a social or a political event that threatens the socioeconomic fabric of the nation.Conclusion

As the founder of modern economics, Adam Smith, put it, it is the economic incentives of the entrepreneurs that ensures that you get bread on your tables every morning. In other words, the entrepreneur is not being altruistic when he goes about his or her business. Rather, it is his selfishness in making a profit that contributes to the economies of nations. Therefore, one must realize the fact that profit is not a bad word and that once everybody agrees that economic aspects keep us going, and then all of us would benefit since we would think rationally and objectively about the need to create an ecosystem for ourselves and by extension, contribute to the economic development of nations. In short, let us celebrate the astounding entrepreneurial spirit in ourselves and in others, and instead of creating impediments, let us ensure that we enable and empower ourselves and others in fostering creativity and innovation.When Should Entrepreneurs Transition to Next Generation of Leaders

Why do Entrepreneurs Exit ?

Entrepreneurs launch new ventures some of which go on to become successful and game changing businesses. When the ventures become hits in their own right, some entrepreneurs hand over the reins to others whereas some sell their ventures or their stakes to other investors and businesspersons. Think of Sabeer Bhatia who launched Hotmail which was subsequently bought over by Microsoft. Hotmail was indeed a game changer wherein Bhatia brought to fruition the world’s first free web based email service. This was a classic example of an entrepreneur who was impatient to launch other ideas and ventures though it needs to be mentioned that Bhatia did not taste the heady success that he had with Hotmail.Entrepreneurs who do not Exit

Of course, this example cannot be generalized to all entrepreneurs as many of them manage their ventures well into decades. For instance, Bill Gates of Microsoft is an example of an entrepreneur who managed it for decades before transitioning to the next generation of leaders. The reason for choosing these two examples is because they show how some entrepreneurs look for other ideas and to start new ventures whereas other entrepreneurs are content with managing the ventures that they helped incubate and bring to market. In other words, the question as to when should entrepreneurs exit their ventures if they do at all and the question as to when should they transition to new leaders and the next generation is something that depends on a combination of factors.When is the Right Time to Exit ?

For instance, it was recently announced that the Indian IT (Information Technology) bellwether, Infosys, would no longer have any of the founders in executive positions and instead, the appointment of a non-founder as CEO (Chief Executive Officer) was supposed to mark the transition from the entrepreneurs to professionals from outside. Indeed, this decision was also accompanied by an announcement that the founders would no longer be called promoters and that henceforth; they would be treated as any other shareholders. The case of Infosys is an example of how the founders and promoters of successful ventures often face the dilemma of when to exit their ventures.The need for Self Actualization

Indeed, except for family owned enterprises such as Fidelity, TATA group, and to a certain extent, the Reliance conglomerate, it is often the case that there comes a time in the evolution of businesses where the promoters and the founders feel that they have done their bit and hence, it is time to move on. In some cases such as Sabeer Bhatia, it is the thrill of launching new ventures again and again whereas in other cases, it is for the reason that many entrepreneurs would like to become angel investors and Sherpa’s for the younger generation. This desire corresponds to the Self Actualization phase of the Maslow Needs Hierarchy model wherein the entrepreneurs feel that they have to become social champions and visionaries wherein their ideals can be used for the benefit of society rather than only for the firms that they have founded.Entrepreneurs being forced out

Having said that, it must also be noted that some entrepreneurs are literally forced out of their positions because the investors and other board members feel the need for new faces in addition to corporate intrigues which are done by stealth. Think of the late legendary Steve Jobs who in his first stint at Apple was forced to leave though what happened subsequently was that he was brought back to turnaround the firm. Indeed, Jobs had the last laugh (literally and figuratively) as he engineered the transformation of Apple into the world’s largest company by market capitalization.Continuing the same point, there are other cases of entrepreneurs who have been edged out of their positions as promoters and founders. The reasons for this range from non-performance or simply the feeling that “he or she has lost their touch” and the aspect of the institutional investors insisting on professional management rather than family ownership. The lesson for us here is that it is better for entrepreneurs to quit or exit the firms when the going is good instead of clinging on to their positions and being forced out or realizing that they cannot add value anymore.

Divergence between Founders vision and Ground Realities

Another reason for such exits is that when the firms become too large or big, the vision of the founders and the ground realities in them become so divorced from each other that the founders realize that it is time for them to move on. This was the case with Infosys wherein it became a behemoth where ground realities were vastly different from what the founders wanted in recent years. Despite the best efforts of many stakeholders of Infosys, the realization that it was time to move on finally dawned on all concerned. This was driven by the fact that Infosys was widely perceived to have lost its Mojo because of this divergence.Conclusion

Finally, some entrepreneurs plan the transition to the next generation well in advance and though this is an ideal that few can match, nonetheless, many experts believe that this is the best course of action for all concerned. Though examples of this kind of transition are rare, it has been known to happen in earlier decades wherein firms such as Unilever and Proctor and Gamble witnessed transitions from the founders to the next generation that was not a result of corporate battles but was instead driven by a conscious decision on part of the founders.Venture Capitalists and Irrational Exuberance

The Dotcom Boom and Irrational Exuberance

For those who started their careers in the late 1990s and early 2000s would remember the Dotcom boom when the internet and software based businesses were expected to drive the future economic growth in the United States and elsewhere. Named because companies with a .com address were projecting high growth and endless revenues, this boom sparked frenzy in Venture Capital investing in these firms. However, the boom soon went bust leaving in its wake a string of failed companies, entrepreneurs who went bankrupt and venture capitalists who suffered huge losses sometimes of their own money. If there was a lesson from this boom and subsequent bust, it is that irrational exuberance in economies must be tempered with rational and cool headed thinking where people are not carried away by the transient and temporary.History Repeats Itself

Having said that, the nature of the markets and economies is such that lessons are rarely learnt from history and within a gap of a few years, another boom in the US economy started where venture capitalists again started funding entrepreneurs with little or no experience in running companies. Before we proceed further, we would like to make it clear that we are not per se against investing in startups or funding brilliant ideas.Indeed, the nature of capitalism is such that disruptive innovation and creative destruction are the norm. However, what we are against is the mass mania kind of investing cycles where irrationality takes over and VCs start pouring in money in firms that do not have fundamentally strong business plans. Thus, what we caution against is irrational exuberance and illogical investing.

Are VCs Rational ?

One might very well ask, why do the VCs who are industry veterans with decades of experience in investing and funding startups go wrong? Further, why would they want to invest badly and lose even more badly? The answers to these questions lie in the mechanics of global capital wherein “Easy money” and “high liquidity” means that the money has to go somewhere and this is where sometimes VCs tend to display irrational exuberance. Further, given the fact that returns on keeping money idle is less and the opportunity costs are more, it makes sense for these VCs to look to invest in companies that promise returns if only on paper. This is the reason why periodic bouts of market madness are witnessed wherein even the most venerated and experienced VCs tend to go wrong.Hunt for Value Investments

Of course, this is not to say that VCs fund every entrepreneur who comes knocking. Indeed, research has shown that out of hundreds of applicants for funding, a handful are finally funded meaning that competition is intense. Therefore, it follows from this that VCs are always on the lookout for opportunities because they want to invest in companies with a bright future. Considering that they have to deal with “junk ideas” on a daily basis, they usually zero in on what their models of investing suggest would be profitable.A Recent Example

A recent example is the Indian e-business portal Flipkart receiving a Billion Dollars in capital infusion from abroad. While there are many who question whether Flipkart would be able to justify such huge investments, there are others who believe that given the rather weak market for funding in recent years, this company has a solid business model and hence, can be trusted to deliver. The key take-away from this example is that we are of the view that such deals should be based on rational and logical valuations and not because the VCs have money to spare or because the future lies in the emerging markets. In conclusion, as long as there is money to invest there would be VCs and as long as there are VCs, there would be entrepreneurs on the lookout for funding. Therefore, the key point to note here is that it is important to find balance and not get carried away by the crowd.Working for Startups - Pros and Cons

Why Graduates are Flocking to Startups

In recent years, many fresh graduates as well as experienced professionals want to work for startups as they feel that by doing so, they would be adding value to themselves as well as being part of an exciting and creative journey. The first aspect about adding value for themselves comes from the fact that startups often work in an unstructured manner where out of box thinking and dealing with uncertainty are the norms. This means that employees of startups would learn critical and essential problem solving skills which would help them later on in their career.The second aspect is because many feel that by being part of a concept or a venture that is new and represents a change from traditional companies would be challenging and stimulating to them. These then are some of the reasons why many graduates want to work in startups which as recent placement season statistics show lapped up more than 50 percent of the graduating class in many business schools.

Some Risks of Working for Startups

Having said that, there are a few things to consider before committing oneself to a startup. To start with, there is no guarantee that the venture would succeed and be a source of stable income for the longer term. Indeed, the fact that many startups fail after a few years means that if you want to work for them, you must be prepared to take the rough along with the smooth. Next, many startups entice graduates with offers of stock options after they go public. The assumption here is that the startup if it becomes public would reap a windfall from the stocks. However, we reckon that this is a big risk because not all startups eventually go public and even if they do, they are not guaranteed of a booming rise in their share prices. Consider the example of Facebook which despite its high valuations flattered to deceive after its IPO or Initial Public Offering bombed in the market.Do your Due Diligence

We are not trying to scare away the people away from the startups. Rather the intention here is to remind you that you must do your due diligence before committing yourself. Indeed, more often than not, startups offer exciting career prospects that include interacting with many famous people in the industry as startups are known to encourage even the newcomers to take more responsibility than they would get in established companies. Moreover, the thrill of seeing your work make waves is something that only an entrepreneurial venture can provide you. Apart from that, the fact that startups offer creative people a chance to put their creativity to good use. In addition, potential entrepreneurs who want to launch their own startups sometime in the future would learn a lot from working for such ventures in the initial phases of their career.Conclusion: Does your personality fit that of the Startups ?

On balance, it would seem that the positive aspects of working for startups outweigh the risks. An important determinant of whether startups are made for you and vice versa would be your personality as well as your inherent tendencies towards risk and rewards. Working in startups is not for those who have many personal commitments because of the risks that were described earlier. On the other hand, startups are ideal for those who do not particularly like hierarchy and want independence. Therefore, check these aspects and determine whether you are a right fit for the startups.Public Private Partnership Projects: The Indian Experience

Introduction

Infrastructure is crucial to the growth and sustenance of the Indian economy. With the country being a developing one which is just now beginning to enter the trajectory of economic growth that would catapult it into the league of developed countries, it is vital for massive investments to be made in infrastructure and the construction of airports, ports, highways, and public housing.Since the Indian government is perennially strapped for cash, which is the case with other developing countries as well, there is a need for the private sector to pitch in and contribute to the development of the economy. Having said that, it must also be noted that for such private sector participation to actualize, they need to be incentivized economically and financially as well as assured returns on their investment.

Public Private Partnership (PPP) Projects

PPP projects are defined as partnerships between the state and the private sector, which cannot be called, either as complete privatization or complete governmental control. This means that the PPP projects are essentially partnerships that are formed for a specific purpose through the creation of a SPV (Special Purpose Vehicle) that has private sector equity as well as governmental stake in the form of land, water, and other resources that the government can offer the concessionaires to develop infrastructure around them and in them.As has been mentioned in the introduction, PPP projects are the way forward for India, which has limited resources and hence, needs private sector participation as far as possible. Further, given the need to develop infrastructure on a war footing, the private sector with its deep expertise and experience in executing such projects would be in a better position than the government in this respect.

Problems with PPP Projects

Having said that, the experience of the PPP projects in the infrastructure sector in India has been a mixed bag with more failures than successes and the succeeding discussion highlights the problems and suggests some solutions. It would suffice to state here that future partnerships can learn from the successes and avoid the pitfalls that led to the failure of the other projects.Perhaps the biggest problem that bedevils the infrastructure sector and the issue of the PPP projects is that the whole process is not transparent to the various stakeholders other than the governmental bureaucrats. Further, it is also the case that in instances where the PPP projects have failed, the blame game that ensues in the aftermath is usually directed towards the private players.

This creates perverse incentives for the other players who might reconsider their investments. Moreover, with so much of red tape and decision-making paralysis in recent years, investors are reluctant to invest in the PPP projects in India.

Apart from the problem mentioned above, the other risk that private players carry when they execute the PPP projects is that of the political uncertainty factor. It is indeed the case with many projects such as the Hyderabad Metro Rail, the Airport in Bangalore etc that a change in the government meant a review of the project leading to uncertainty over its continuance. This can lead to losses for the private players, as they would have invested substantial amounts of money, which are at risk if the project is cancelled.

Given the pervasive nature of corruption in India, promoters and the private players tend to recoup the losses that they have incurred by way of bribes and lobbying to the public at large meaning that the costs are inflated without a scientific appraisal of such projects. Moreover, given the tentacles of the underground economy, which is estimated to be as big as the official economy, the sources of finance and funding are concerns for both the government and the other stakeholders. In other words, there is no mechanism in place that assesses whether the funding and the financing of the PPP projects is entirely from legitimate sources.

This is a tricky issue as PPP projects entail massive investments and with the chances of failure being high, they are high-risk projects. Therefore, there must be a proper mechanism in place where the risks are identified and allocated in a scientific manner. Shifting the risks on to the private players would be counterproductive as is the placing of too much risk on the government. As would be discussed later, a proper risk and reward system needs to be instituted for this purpose.

No PPP project can be executed without the sovereign guarantees extended by the government, whether at the state or at the central level. The experience of some private players in the PPP projects has been that governments change the terms and conditions o the contracts midway as well as withdraw them in some cases. Having said that, the governmental guarantees cannot become White Elephants as was the case with the Enron plant in Maharashtra.

Conclusion

The preceding discussion has made it clear that unless India embraces PPP projects wholeheartedly, it cannot make the “Great Leap Forward” which China did as far as infrastructure is concerned. Apart from this, the fact that the government is seen as the problem instead of the solution as far as the infrastructure sector is concerned means that the new government has its task cut out in attracting private players to invest in the infrastructure sector.The preceding discussion has highlighted the problems associated with the PPP projects in India and has suggested some solutions. It is evident that most of the problems are systemic and structural in nature, which means that there is an urgent need to overhaul the archaic laws and remove the bureaucratic bottlenecks that stymie the PPP projects. Any discussion on the PPP projects in India is incomplete with a mention of the issue of corruption. Considering the fact that corruption at all levels adds costs to the PPP projects in addition to inflated project appraisals and other deleterious effects, it is indeed the case that this scourge must be tackled immediately.

Apart from these issues, the PPP projects must not be held hostage to political uncertainty and volatility. In other words, a conducive investment climate is the need of the hour in India. In conclusion, India is at the “take-off” stage as far as economic growth is concerned and if it is serious about joining the league of developed nations, it must immediately ramp up investments in the infrastructure sector and actualize the kind of growth rates that are being forecast.

Economics of Public Private Partnerships

Introduction

Public Private Partnerships or the PPP Projects are the answer to the development of countries like India that are starved of resources where the government finds itself unable to commit massive funds for infrastructure development and yet, needs such projects for economic growth. This article examines the economic aspects of the PPP projects by applying theory to the practice as is the case in India. Before launching into the discussion, it would be pertinent to note that PPP projects are here to stay and despite opposition from various quarters, it would be better if the decisions on such projects are made on economic concepts based inputs rather than on the whims and fancies of the players.Incentives and Distortions

To start with, private players must be incentivized to participate in the PPP projects. Starting from the initial tendering to the contract singing and extending to the execution, implementation, and maintenance, at each stage, the private players must be assured of returns on their investment. For instance, it is common for many highways and other construction projects in India to be executed on a Build-Operate- Own/Transfer mode wherein the concessionaire is allowed to levy tolls and collect money from the motorists using such infrastructure. It is the case with the airports wherein the private players can operate them through revenues accrued by way of levies and user development fees.However, in recent years, there has been a tendency by civil society egged on by vested political and other interests to agitate against the levying of tolls on highways. This creates a disincentive for the private sector as they can neither recoup their investment nor transfer the project considering the sunk costs. Therefore, the incentive system must be in place and equally important is the honoring of the contractual obligations by the government in a transparent manner.

Correct Estimation of Risk and Return

Apart from the incentives that must lure the private players, the risk and return equation must not be skewed against the latter and the reward system being offered to the private players must be appropriate to the risks that they are carrying. For instance, it is common in India to draft concessionaire agreements that are skewed in favor of the government in some cases and in favor of the private players in other cases. The determination of as to who is rewarded depends on a host of factors including the closeness of the private players to the powers that be and other forms of crony capitalism. This must be avoided at all costs and the risk and reward equation must be scientific in nature without allowing for biases etc.The Problems of Moral Hazard

Having said that, it must also be noted that in some cases, the Indian government has been bending over backwards to some private players especially in the case of ports and airports. This has taken the form of arranging for soft loans and deferring the payment period as well as bailing them out when necessary. This creates a problem of moral hazard wherein such concessions to some can be demanded by the others as well. The world witnessed the mega bailouts of the big banks in the aftermath of the 2008 financial crisis. Some economists decried such bailouts as being morally hazardous as they reward bad behavior and penalize those who have played by the rules, it is indeed the case that the Indian government would well be advised to draw lessons from this and ensure that it does not fall into this trap.Mapping Demand and Supply

Next, and perhaps the most important aspect as far as economic theory is concerned is that there must be a balanced demand and supply equation as far as the PPP projects are concerned. Recent research indicates that the construction industry has been overly invested in leading to excess supply in the absence of adequate demand. For instance, the inventory buildup in some of the infrastructure projects such as public housing and the creation of SEZs or Special Economic Zones reveals that massive investments have been made in these sectors that have resulted in oversupply.Allocation of Resources

Fourth, the guns vs. butter dilemma is something that the Indian government grapples with as far as PPP projects are concerned. Considering the fact that India is still a developing country and hence, needs to invest massively in creation of social infrastructure, it is faced with a dilemma of channeling investments and partnering with the private sector according to the priorities that are determined by the above aspects. However, it is also the case that India needs modern infrastructure such as world-class airports and hence, cannot shy away from inviting private participation in such ventures. At the same time, there have been vociferous protests against excessive investments in infrastructure that ignore the needs of the average person. Therefore, it is indeed a balancing act for the government as it tries to grapple with this dilemma.Conclusion

As can be seen from the above discussion, PPP projects have to be evaluated financed, and revenue generation done based solely on the economic aspects by applying theory and not because of political or other considerations. For long, the PPP projects in many developing countries have been hostage to political compulsions and hidden agendas of vested interests. It is high time all the stakeholders agreed on evaluating and executing the PPP projects on the basis of the points mentioned in this article rather than on the basis of vote bank politics and crony capitalistic considerations.Entrepreneurship in Emerging Economies: Boom and Bust and Business Models

A New Haven for Western Capital

Ever since the opening up of the global economy in the 1990s, several hitherto Third World countries in Asia and Africa began to liberalize and integrate themselves into the global economic system. This meant that there were more chances for entrepreneurs in these countries and from abroad to flourish because of the business friendly policies pursued by the governments in these countries. This also had the effect of spurring investment and incubating new ventures either due to venture capital investments from the West or due to internally generated or sourced avenues for investment. While the former was helped by the opening up of the financial markets of countries such as India to foreign capital, the latter was helped by the accelerating economic growth in these countries which freed up capital of the business houses that can then spare some money for funding new startups and new ventures.Barriers and Crony Capitalism

Having said that, it must also be noted that despite the liberalization and the laissez faire approach taken by these countries, several obstacles remained in the way of entrepreneurs when they ventured into the business world. For instance, though India witnessed a startup boom in the last decade, until recently, entrepreneurs had to contend with dealing with red tape and bureaucracy which meant that more often than not, they had to face delays in securing approvals and licenses to start their ventures.Moreover, in the initial rush to open new ventures, many entrepreneurs in the emerging economies in Asia such as Indonesia, Thailand, and India resorted to “crony capitalism” which meant that they succeeded not because they had a game changing idea or because their business models were superior, but because they had the right contacts and the right connections which made it easier for them to secure licenses, funding, and other aspects.

The Collapsing Startups

Therefore, these ventures often started with a bang and ended with a whimper once the projected revenues did not materialize due to the deficiency in their business model or due to the fact that most of the stratospheric projections that they made to secure funding were based on flimsy and unrealistic growth and revenue expectations. Matters were also not helped by the global economic crisis of 2008 which saw many such ventures collapsing because of the funding that dried up as well as due to the fact that many of these ventures were based on dubious business practices. In addition, the regulators who by now were aware of these shenanigans quickly started to look deeper into these ventures which meant that they could not rely on their connections alone to sustain themselves. Further, the civil society and the activists fighting such practices became more aware and more conscious of these practices which resulted in greater scrutiny.Success Stories

Of course, this does not mean that all new ventures launched during the economic boom were necessarily based on flawed and corrupt practices. For instance, there are many Asian companies who not only became leaders in their chosen business area but also took their brands global and succeeded in winning in the global marketplace. Indeed, the fact that Asian brands were now recognized for their worth and inherent value generating capabilities is exemplified in the success of the Indian IT Industry, the success of the Chinese companies such as Alibaba, and the spectacular growth of Latin American and African companies. However, the fact remains that in the aftermath of the bust of 2008, many Western venture capitalists were wary of funding emerging market startups without due diligence and started to insist on “showing them the money” or to have robust business models.A New Boom ?

Finally, the situation as it stands now is that eCommerce companies such as Flipkart, Snapdeal, and Myntra in India have attracted Billions of Dollars in funding in recent years. While one cannot paint them with the same brush and conclude that their business models are suspect, the fact remains that most of these eCommerce companies including Uber base their revenue growth projections and estimates on future business as well as gross sales which after discounting cannot be said to yield much in profits. Indeed, the fact that several questions are being raised about the sustainability of these companies must surely caution investors and industry analysts as to whether these companies would not meet the fate of the Dotcom ones that collapsed during the bursting of the tech bubble and other startups that collapsed in the aftermath of the 2008 crisis.Entrepreneurial Challenges and Opportunities in Asia

The Asian Juggernaut

Aspiring entrepreneurs around the world have several opportunities both within their countries as well as in overseas destinations. With the opening up of many Asian economies, western entrepreneurs can now invest in countries such as China and India along with Indonesia and Thailand in addition to the latest entrants Vietnam and Cambodia.Indeed, all these economies have been growing at a faster rate than the ones in Latin America and Eastern Europe. Having said that, it must be noted that despite the governments in these countries being business friendly and open to foreign investment, the ground realities are such that entrepreneurs might find the going tough due to a number of reasons.

Challenges for Doing Business

- First, the red tape and the bureaucracy in these countries means that unless the entrepreneur is well connected locally, he or she would be facing hurdles in land acquisition, licenses, and other approvals. In addition, the legal system in many of these countries is slow moving and archaic meaning that honoring of contracts and arbitration in case of legal disputes would take a long time and more importantly, would be subject to age old laws and regulations.

- Second, despite the enthusiasm at the national level, entrepreneurs would have to deal with the state and provincial governments in these countries which have their own set of policies governing business and regulating commerce.

- Third, the infrastructure in these countries is sometimes not up to global and western standards meaning that bad roads, erratic and poor power supply, irregular water, and urban congestion mean that the entrepreneurs have to deal with these challenges as well. Fourth, social stability and unrest are big risk factors as is the aspect of safety of women which means that unless the entrepreneur is planning to have a setup with minimal staff, he or she would have to contend with all these issues as well.

Opportunities for Growth

However, the picture is not as gloomy as it sounds since there are still some bright spots in these countries that offer entrepreneurs the chance to actualize their dreams. For one, the emerging middle classes in these countries are a source of rich workforce which means that there is a readily available base for the entrepreneurs to hire. Second, the wages are low by western standards and this means that any venture in these countries can be carried out at substantially low costs than in the west. Third, the purchasing power of the people in these countries is growing meaning that there is a ready and untapped market for consumer goods and durables.Finding the Balance

Therefore, it is evident that while there are challenges there are opportunities as well and vice versa and hence, finding balance is up to the entrepreneurs so that their businesses or ventures can succeed. There are a number of ways in which the entrepreneurs can ensure success of their ventures and this is in finding creative and innovative solutions to the problems. For instance, both Shanghai in China and Bangalore in India have emerged as innovation hotspots where new startups and ventures are succeeding. In addition, Ho Chi Minh City in Vietnam and Laos in Cambodia have emerged as viable contenders to these countries though they are still far behind.Some Booming Sectors

The point that we are trying to make is that these countries offer the much needed worker and purchasing power capabilities in addition to having oases of business incubators amidst the chaos. Indeed, if one looks at the number of tech startups in Bangalore in the last two years and the number of biotech and alternative energy ventures in Shanghai, there is a distinct feeling that the entrepreneurial energy is being unleashed after a lull following the 2008 global economic crisis.The success of the eCommerce ventures in China and India wherein companies such as Alibaba and Flipkart have been growing exponentially means that there are enough opportunities for growth in these countries. This is the reason why many venture capitalists and angel investors have been pouring money into these sectors in addition to global giants such as Amazon setting up their regional bases.

Growth is not a Luxury but a Necessity

Finally, all these countries are making efforts to harness the power of the entrepreneurs since the governments as well as the people have realized that unless they grow and continue to grow, ensuring that the young get jobs and actualizing stability for the people would be difficult leading to chaos and unrest. Therefore, it is the case that these countries do not have the luxury of waiting for growth to happen and instead, they have to make it happen and this is something that entrepreneurs can take heart from.Entrepreneurs and Hot Money Flows and Investments

The Symbiotic Relationship between Financiers and Entrepreneurs

Entrepreneurs need funding and venture capitalists and financiers need emerging businesses with great potential for investments. Therefore, there is a symbiotic relationship with entrepreneurs and the financiers wherein each need the other for mutual gain. While the entrepreneurs would use the capital invested by the financiers to grow and expand their businesses as well as the more important aspect of returning profits on the investment, the financiers would benefit from the profits since their investments are generating returns.Having said that, it is certainly not the case that financiers invest in just about every new business without doing their due diligence. Indeed, one of the key aspects about entrepreneurship and entrepreneurs is that they need to have compelling business idea and a robust business model that would convince the financiers to invest in their companies. This is one of the reasons why entrepreneurs find it hard to raise funds especially during economic downturns since the financiers would insist on robust and profit making business models which not all entrepreneurs can come up with.

What is “Hot Money” and How it Impacts Entrepreneurs